EUFIC Forum N°8 - Consumer Attitudes towards ‘Free-From’ Labels

Last Updated : 20 January 2017- Key Findings

- Study Aims

- How was the study conducted?

- Key Results

- How do people evaluate the healthiness of products labelled with ‘free-from’ claims?

- To what extent do consumers look for ‘free-from’ labels when doing their grocery shopping?

- Do consumers trust ‘free-from’ labels?

- Do these labels help consumers in their purchasing decisions?

- How willing are consumers to buy products with ‘free-from’ labels if these products are more expensive than similar products without the label?

- How interested are consumers in natural products?

- How is consumers’ trust affected when they learn that ‘free from’ does not necessarily mean ‘healthier’?

- Conclusions

Key Findings

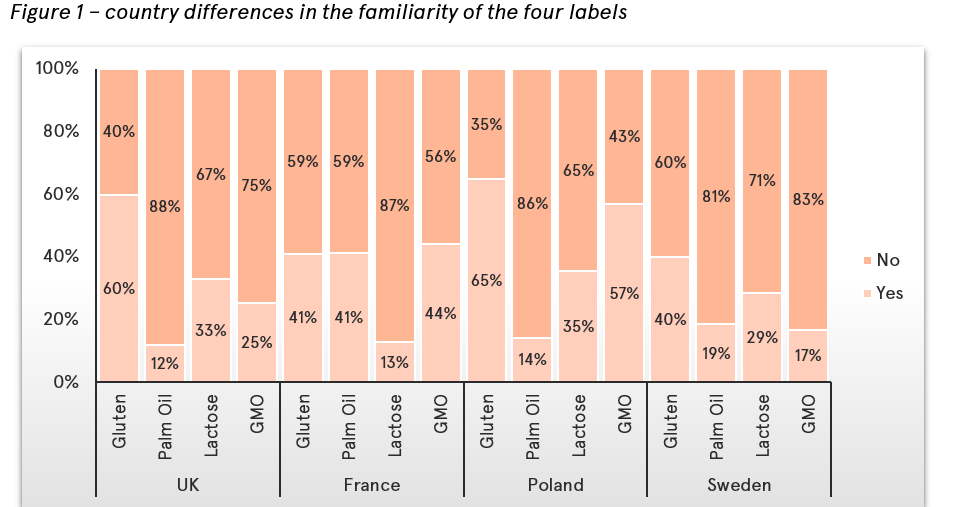

- The majority of consumers that took part in the online survey have seen labels with the term ‘gluten-free’ before, but not necessarily labels with either ‘lactose-free’, ‘palm oil-free’ or ‘GMO-free’.

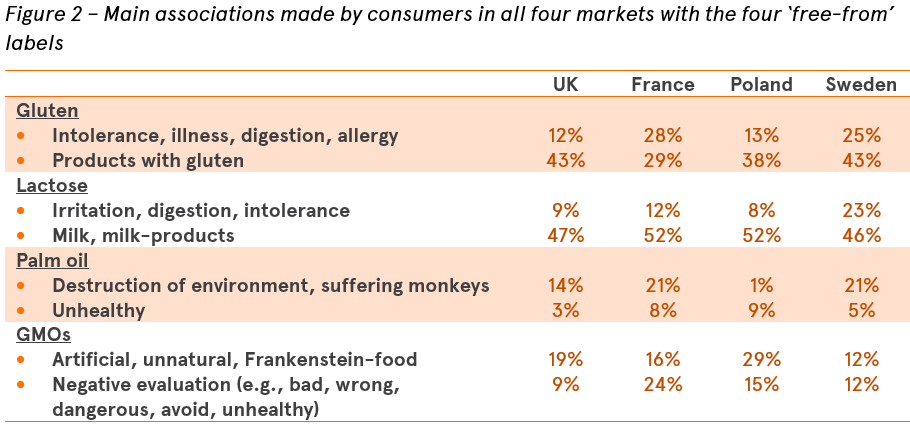

- Consumers associate the terms ‘gluten’ and ‘lactose’ predominantly with health concerns and products containing those ingredients. While consumers in Poland associate the term ‘palm-oil’ as mostly healthy, consumers in the UK, France and Sweden relate the term ‘palm-oil’ predominantly to environmental issues and ethical concerns. Regarding the term ‘GMO’, the majority of consumers associate it with artificial and unnatural foods.

- Awareness of ‘free-from’ labels varies significantly between countries. In general, the ‘gluten-free’ and ‘lactose-free’ labels tend to be more well-known across countries compared to ‘palm oil-free’ and ‘GMO-free’ labels. Poland is the most aware of ‘free-from’ labels out of the four countries, followed closely by France, then the UK and finally Sweden which shows the least awareness.

- ‘Free-from’ labelled products across all countries are generally perceived as healthier compared to products without such a label.

- Consumers, across all countries and across all four ‘free-from’ labels researched in this study, generally find the labels either trustworthy or at least somewhat trustworthy.

- Overall, the majority of participants do not look for ‘free-from’ labels when doing their grocery shopping. However, a significantly higher number of French participants look for the ‘palm oil-free’ label and the ‘GMO-free’ label when food shopping, compared to other countries.

- For both ‘gluten-free’ and ‘lactose-free’, the nutritional value of food products is the most important factor when consumers were looking for ‘free-from’ labels. For the ‘palm oil-free’ label, the relevance of nutritional value, environmental concern and food safety varies between countries. For the ‘GMO-free’ label, safety reasons stand out as the most important factor; this is true for most countries, except in the UK, where the main concern is the nutritional value.

Study Aims

The main objective of this study has been to explore and comprehend the attitudes of European consumers towards ‘free-from’ labels, by producing science-based consumer research on the following:

- Awareness and interpretation of ‘free-from’ labelling terms

- Healthfulness perception of products carrying ‘free-from’ labels

- Role of ‘free-from’ labels in food choice and purchasing behaviour

The research focussed on the following questions:

- How do consumers interpret ‘free-from’ labelling terms?

- Do they find this information useful and do they feel it provides them with the information they need to make their purchasing decisions?

- How do these ‘free-from’ labels influence purchase behaviour (e.g. willingness to buy)?

- Do consumers think that the absence of an ingredient (‘free-from x’) improves the nutritional value/healthiness/safety of a product?

- How is consumers’ trust affected when they learn that ‘free-from’ does not necessarily mean ‘healthier’?

How was the study conducted?

This study was conducted across four countries: The United Kingdom, France, Poland and Sweden. The research was conducted by the European Food Information Council, assisted by Professor Michael Siegrist and Dr Christina Hartmann from ETH Zurich; the panels of the participants were provided by MMR Research Worldwide.

The study is composed of several parts, most of which quantitative, but also some qualitative. Both parts were set within a 25-minute online survey, targeted at 500 participants per country. The representative sample comprised a total of 2192 participants – of which 692 were from the UK, and 500 for each remaining country, France, Poland and Sweden. The participants were selected for a nationally representative sample, with quotas set on gender (approximately half male and half female), age (18 to 64) and socio-economic status. Those who had actual allergies or medically diagnosed intolerances to either gluten or lactose were excluded, due to their specific medical condition. Most participants were either in full-time or part-time employment, and all participants were the primary grocery shoppers for their households.

A pilot study was conducted in the UK during August 2016. After some small amendments, the survey was fully launched in all four markets, from the 25th of August to the 2nd of September 2016.

The questionnaire consisted of the following parts:

- General health and nutrition interest of consumers

- Familiarity and understanding of the four ‘free-from’ labels: ‘gluten-free’, ‘palm oil-free’, ‘lactose-free’, and ‘GMO-free’

- A healthiness rating of various product categories with and without each of the labels

- The impact of ‘free-from’ labels on food choice and purchase behaviour

- Interest in naturalness of food products

- Trust in the food industry, the food safety authorities, food scientists and food retailers

The qualitative part of the study consisted of freely expressed associations. The participants were asked what the first words, images or thoughts were that spontaneously came to mind when presented with the four ‘free-from’ labels. All answers were coded into thematic groups (e.g. ‘good for health’ or ‘environmental concern’). Participants were also asked to rate their associations on an 11-point scale from -5 = extremely negative to +5 = extremely positive.

Key Results

The core part of the study was constructed around the interpretation and use of the following four ‘free-from’ labels.

How familiar are consumers with these labels? “Prior to this survey, had you seen a label like this before?”

The majority of consumers that took part in the online survey have seen labels with the term ‘gluten-free’ before, but not labels with either ‘lactose-free’, ‘palm oil-free’ or ‘GMO-free’.

Most respondents had never seen a ‘palm oil-free’ label before this study. To a certain extent, this is true for all four markets, however, France did have a slightly higher knowledge of the label compared to the other three countries analysed in this study.

Overall, there was a higher level of awareness of the ‘gluten-free’ label compared to the other ‘free-from’ labels, except in France where the most known label is the ‘GMO-free’ label.

What do consumers associate with these labels? “When you think of this type of product, what are the first words, images or thoughts that spontaneously come to mind?”

The majority of consumers have some level of familiarity with ‘gluten’ across all four markets analysed. Consumers know that it has something to do with intolerances or allergies, can cause digestion issues and illnesses, and they also know that certain products can contain it. However, only a handful of people freely associated ‘free-from’ products to the term ‘gluten’.

Around 20% of participants had no associations, said ‘do not know’, or gave invalid responses. This indicates that many participants have limited knowledge on what ‘gluten’ is or means, and/or have no associations to it. Most ‘gluten’ associations were neither positive nor negative: between 29% in Sweden and 44% in the UK answered in a neutral way.

Around 20% of the participants in Sweden and France associate ‘palm oil’ with a high environmental impact of palm oil production (e.g. destruction of forests and of monkey habitats). In contrast, participants in Poland do not seem to be aware of any environmental impact of palm oil production. They more often associated ‘palm oil’ as being something either healthy (11%) or unhealthy (9%).

Some people in Sweden, Poland and the UK associated ‘palm oil’ with palms and something exotic, signifying that they aren’t familiar with the label. Missing answers or ‘do not know’ answers made for approximately 30% of the responses in both France and Poland, and approximately 55% in the UK and Sweden. Most ‘palm oil’ associations were rated as either extremely negative or somewhat neutral.

Compared to ‘gluten’ or ‘palm oil’, more people reported associations with ‘lactose’ – there were less missing or ‘do not know’ responses. The majority of participants in all four countries associated ‘lactose’ with milk and milk products. Swedish participants mentioned ‘digestion problems’, ‘intolerances’ and ‘intestinal irritations’ more often compared to people in the other three countries. More people in Sweden mentioned ‘free-from products’ as their first association. In France and Poland almost no one mentioned ‘free-from products’. Similar to ‘gluten’, most associations to ‘lactose’ were neither negative nor positive.

Approximately 10% of participants in Sweden, 15% in France, 20% in the UK and 30% in Poland associated ‘GMOs’ with ‘unnatural’ ingredients. The most frequently mentioned associations for ‘GMOs’ in Poland and the UK were ‘artificial’, ‘unnatural’, ‘not organic’, ‘creepy food’ and ‘mutations’. In France, people mainly mentioned negative associations, for example ‘bad’, ‘dangerous’ or ‘unhealthy’ (around 32%). There were a lot of missing responses in the UK sample which could indicate that those questioned might not be that familiar with the topic, have no strong feelings or have doubts about ‘GMOs’ or have no associations. Across all four markets, most associations to ‘GMOs’, approximately 40%, are extremely negative, with 21% of answers being neutral.

How do people evaluate the healthiness of products labelled with ‘free-from’ claims?

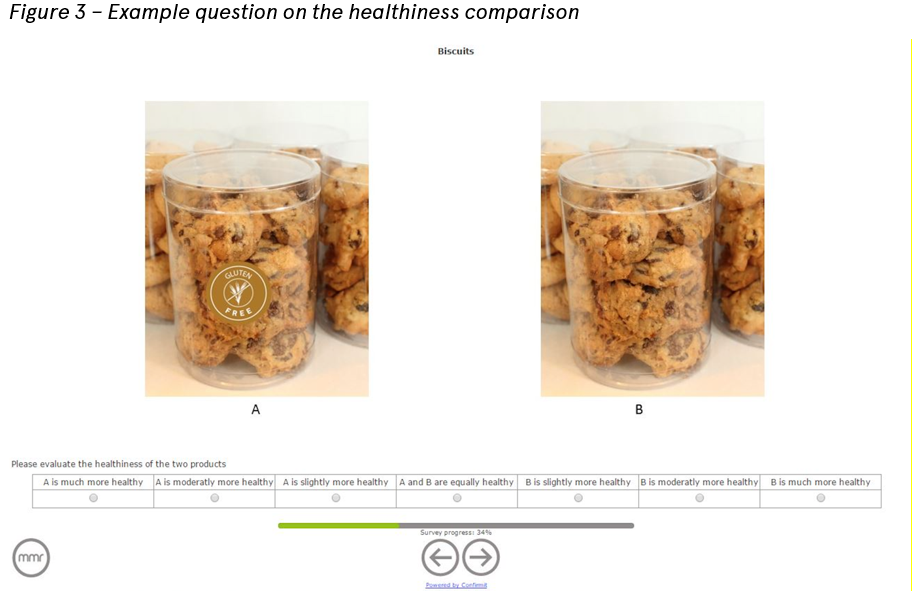

Participants were shown up to three products per label for comparison: they were shown two pictures of the same product – one with the ‘free-from’ label and one without – and were asked to compare the healthiness of the two products. The following product categories were shown for each of the four ‘free-from’ labels:

- ‘gluten-free’: pictures of bread, pasta and biscuits, with and without the ‘gluten-free’ label

- ‘lactose-free’: pictures of milk, cheese and yogurt, with and without the ‘lactose-free’ label

- ‘palm oil-free’: pictures of chocolate spread, a chocolate bar, and margarine, with and without the ‘palm oil-free’ label

- ‘GMO-free’: pictures of cooking oil, a chocolate bar and corn, both with and without the ‘GMO-free label’

In general, products carrying free-from labels are perceived as either slightly or significantly healthier than products without the label.

“Please evaluate the healthiness of the two products”

Polish consumers perceived all three products with the ‘gluten-free’ label as even more healthier compared to participants from the other countries.

Products with the ‘palm oil-free’ label were perceived as much healthier compared with the same product without such a label. However, there were significant country differences: consumers in France perceived products with the label ‘palm oil-free’ as significantly healthier compared to consumers in other countries and the smallest difference in healthiness perception between products with and without the label was observed for consumers from the UK.

Consumers in Sweden do not seem to think that ‘lactose-free’ products are much healthier than products without such a label. This may be due to the fact that “lactose tolerance is exceptionally widespread in Northern European countries such as Sweden” .

Products carrying the ‘GMO-free’ label are perceived as much healthier than products without the label but there were again considerable country differences. Consumers in France and Poland perceived ‘GMO-free’ labelled products as much healthier compared with consumers from the UK and Sweden.

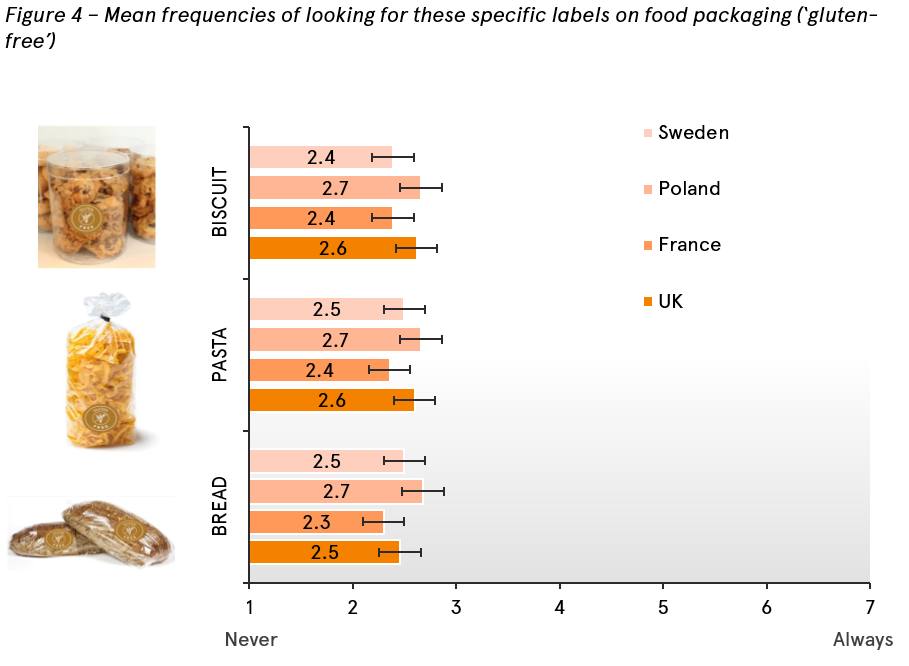

To what extent do consumers look for ‘free-from’ labels when doing their grocery shopping?

Participants had to indicate on a 7-point response scale (where 1=never and 7=always) to what extent they currently look for ‘free-from’ labels when food shopping. Overall, the majority of participants do not look for ‘free-from’ labels when doing their grocery shopping.

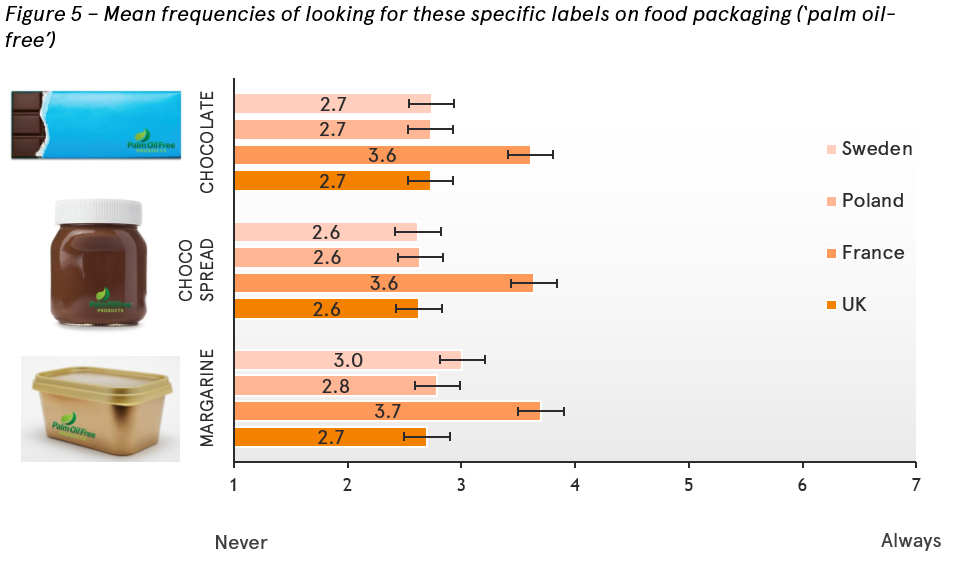

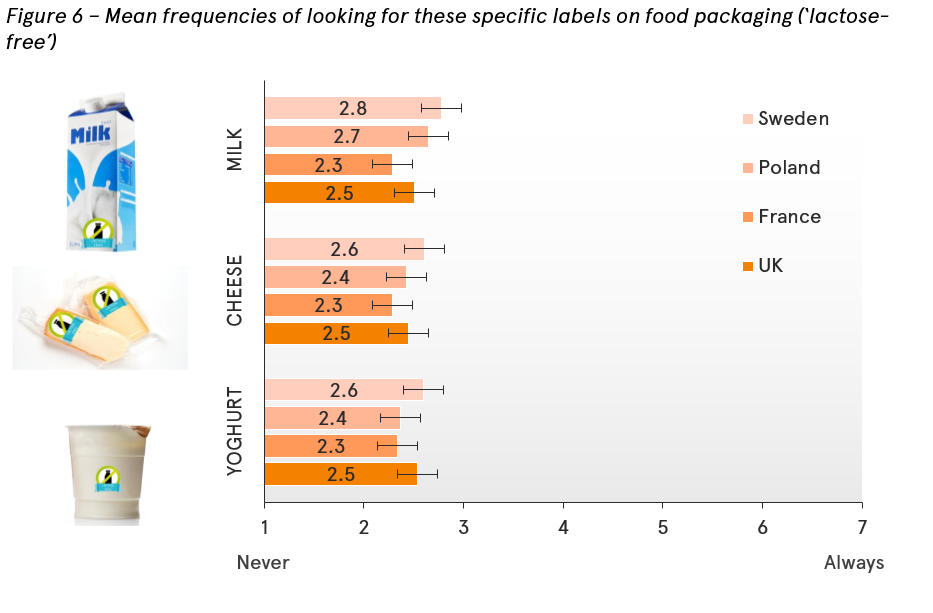

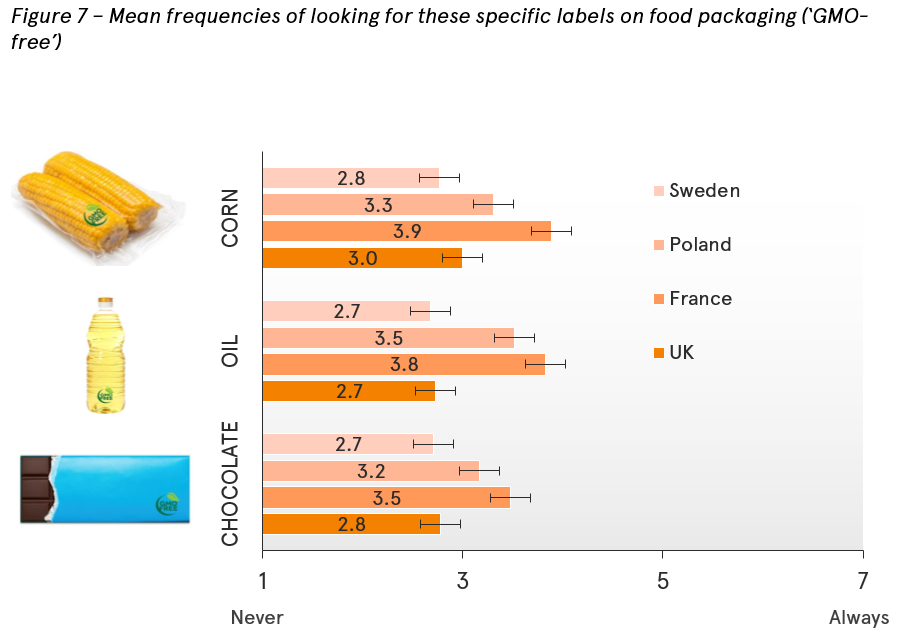

For ‘gluten-free’ labels however, as can be seen in figure 4, people in Poland seem to look for this label somewhat more often compared to people in France; and for the ‘lactose-free’ label (figure 5), people in the UK and Sweden look for the label more often than those in France or Poland. A significantly higher number of French participants look for the ‘palm oil-free’ label (figure 6) and the ‘GMO-free’ label (figure 7) when food shopping.

“To what extent do you currently look for this label when buying products such as these?”

“To what extent do you currently look for this label when buying products such as these?”

“To what extent do you currently look for this label when buying products such as these?”

“To what extent do you currently look for this label when buying products such as these?”

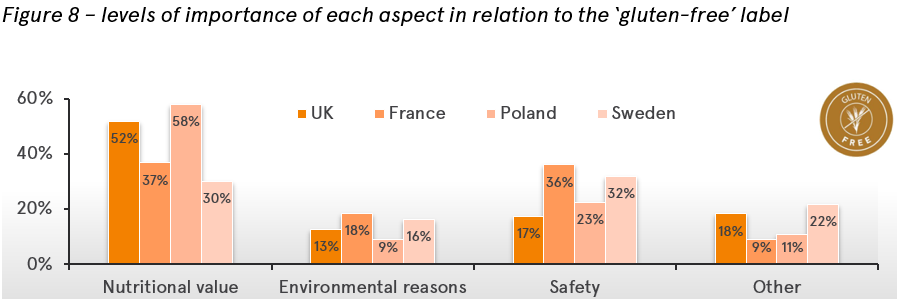

Why do consumers look for ‘free-from’ labels? “Why do you currently look for this label when buying products such as these? (‘gluten-free’ label)”

“Why do you currently look for this label when buying products such as these? (‘lactose-free’ label)”

In general, participants are quite concerned with various issues relating to ‘free-from’ labels, in both health and environmental aspects. For both ‘gluten’ and ‘lactose’, the nutritional value of food products was the most important factor, with 52% and 53% respectively of the participants in the UK and 58% and 52% respectively of the participants in Poland looking for the ‘gluten-free’ and ‘lactose-free’ labels while food shopping. Around 30% of Swedish participants mentioned both nutritional value and safety as equal reasons for looking for these labels.

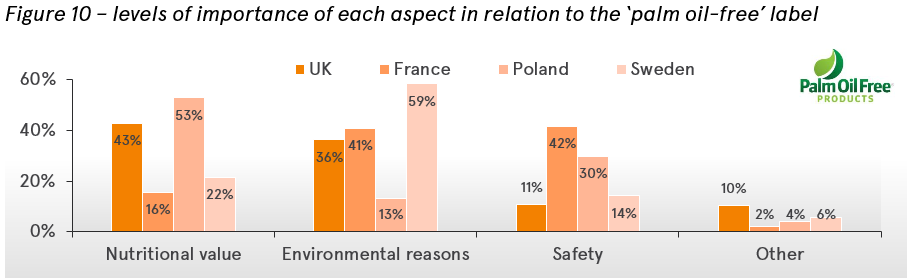

“Why do you currently look for this label when buying products such as these? (‘palm oil-free’ label)”

Concerning the ‘palm oil-free’ label, the relevance of nutritional value, environmental concern and food safety varies between countries – nutritional value being the most important aspect for consumers in the UK and Poland, environmental reasons the most important for Swedes, and both environmental and food safety reasons equally important for French consumers.

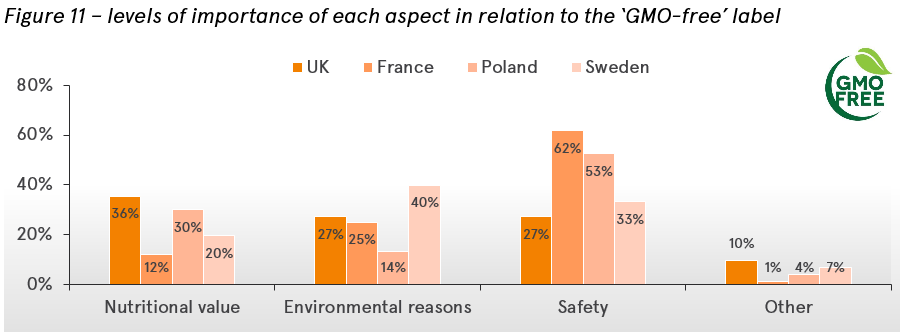

“Why do you currently look for this label when buying products such as these? (‘GMO-free’ label)”

For ‘GMOs’, safety reasons stand out as the most important factor for most countries, especially in France. This is true for most countries, except in the UK, where the main concern regarding ‘GMOs’ is their nutritional value.

Do consumers trust ‘free-from’ labels?

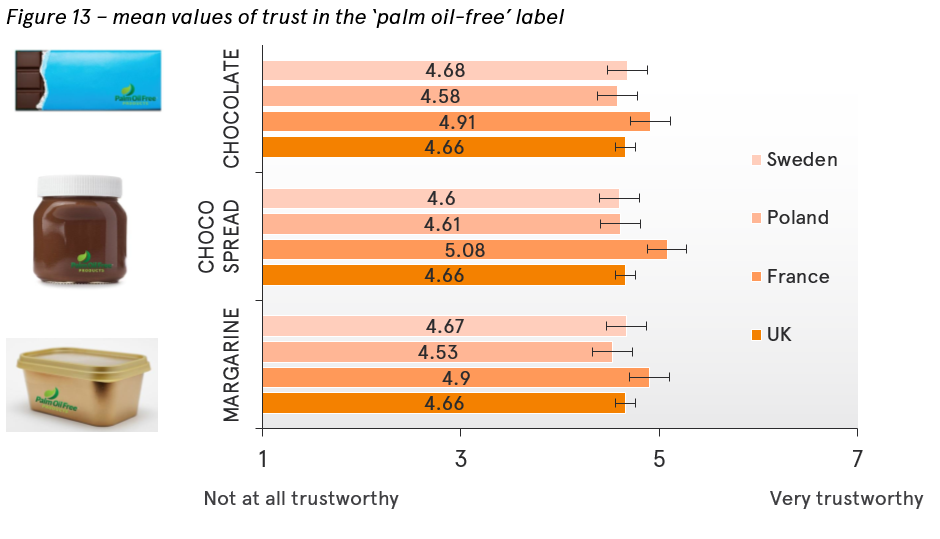

Participants were asked to express, on a 7-point scale (where 1=not at all trustworthy and 7=very trustworthy) how trustworthy they found the information on the four ‘free-from’ labels.

Consumers, across all countries and across all four ‘free-from’ labels generally find the labels either trustworthy or at least somewhat trustworthy.

“How trustworthy do you find this information?”

“How trustworthy do you find this information?”

“How trustworthy do you find this information?”

“How trustworthy do you find this information?”

Do these labels help consumers in their purchasing decisions?

Participants were asked to express, on a 7-point scale (where 1=not at all likely and 7=very likely) how useful they found the four ‘free-from’ labels in helping them make a purchasing decision.

Generally, consumers are somewhat unlikely to find ‘free-from’ labels useful in their purchasing decisions, but country differences do exist. Polish consumers consistently expressed the usefulness of all four labels, claiming that they do help in making their purchasing decisions. French consumers, did not find ‘gluten-free’ and ‘lactose-free’ labels useful for their purchase decisions whereas ‘palm oil-free’ and ‘GMO-free’ labels were rated as more useful for their purchasing decisions.

“Do you find the information in this label useful in helping you make a purchase decision?”

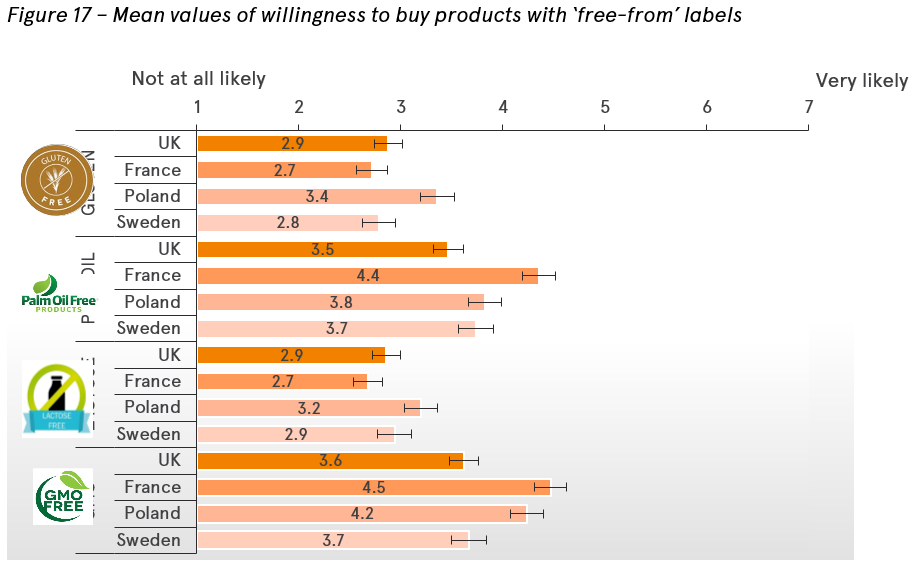

How willing are consumers to buy products with ‘free-from’ labels if these products are more expensive than similar products without the label?

On a scale of 1=not likely at all to 7=very likely, participants rated how willing they were to pay a higher price for products carrying the ‘free-from’ label. With the exception of products labelled as ‘palm oil-free’ and ‘GMO-free’ in France, or ‘GMO-free’ in Poland, in general consumers are not willing to pay more for ‘free-from’ labelled products.

“If you saw this label on a product package and the price would be higher than on other similar products without the label, how likely would you be to purchase the labelled product?”

How interested are consumers in natural products?

Figure 19 below shows the percentage of respondents that agree with the mentioned statements (only answers 4, 5 and 6 from a scale with 1=do not agree at all and 6=completely agree are shown). Naturalness appears to be an important aspect for all consumers, though agreement varies by country.

Consistently, the UK gives less importance to naturalness and natural foods, followed closely by Sweden. France, however, gives a lot of importance to naturalness, and scores higher than any of the other three countries.

Although naturalness seems to be an important aspect for most people, their willingness to pay a higher price for these so-called ‘natural’ products certainly does not correspond completely. As such, price remains a predominant aspect in food choice.

“To what extent do you agree or disagree with the following statements?”

How is consumers’ trust affected when they learn that ‘free from’ does not necessarily mean ‘healthier’?

“Imagine that you have bought a product with the following label. After the purchase, you learn that this product is not healthier than a product without such a label. To what extent do you agree or disagree with the following statements?”

Participants were confronted with this statement, at the end of the study, and were then shown a number of statements. They were asked to evaluate on a 7-point scale (1=do not agree at all and 7=completely agree) to what extent they agree with the following 8 statements:

- ‘I would feel deceived’

- ‘I would feel disappointed’

- I would feel ripped off by the food industry’

- ‘I would feel relieved’

- ‘I did not expect any additional health effects’

- ‘I would be surprised’

- ‘I suspected this to be the case’ and

- ‘It wouldn’t bother me’

Across all four labels, consumers in France and Poland would feel more ‘surprised’, ‘deceived’, ‘disappointed’ and ‘ripped off’ than consumers in either the UK or Sweden. Consumers in the UK and Sweden were not surprised that the products are not healthier. Consistently across all four labels and across all four countries, no consumer would ‘feel relieved’, and similarly, the majority of consumers had ‘no expectations’.

Regarding ‘GMOs’, consumers from all countries experienced stronger negative emotions if they learned that products with ‘GMO-free’ labels were not healthier compared with products without such a label. Consumers in France and Poland reported even more negative reactions compared with consumers in the UK and Sweden. No substantial differences were found between the four labels, meaning that regardless of which ingredient the product is free from, simply any ‘free-from’ label would result in the same reactions from consumers in these four countries.

Conclusions

Most people in all the countries where the survey was undertaken have a basic knowledge of both ‘gluten’ and ‘lactose’, and correctly associate them with products which contain those ingredients. Further, both ingredients were also associated with digestive disorders, which is accurate if consumers have allergies and intolerances. For both ‘gluten-free’ and ‘lactose-free’ labels, consumers in Poland perceived these products as even more healthy than consumers in the UK, France or Sweden did.

Overall, only a small number of people in all four countries look for these labels while food shopping, but when they do, nutritional value is the most important factor when looking for either ‘gluten-free’ or ‘lactose-free’ labels. French consumers mainly relate all four ‘free-from’ labels to food safety considerations.

On the whole, there seems to be a lack of knowledge amongst consumers about both ‘palm oil’ and ‘GMOs’. In Sweden and France, ‘palm oil’ appears to have a very negative image. People associate ‘palm-oil’ with the destruction of the environment, demolition of monkey habitats and, especially in France, with something that is unhealthy. They also associate ‘GMOs’, very negatively, to artificial and unnatural ingredients.

Consumers in France and Poland also trust both labels somewhat more than in the other countries, and consider products with ‘palm oil-free’ and ‘GMO-free’ labels to be considerably healthier compared to products without such a label. A significantly higher number of French and Polish participants look for such a label mainly for safety reasons (‘GMOs’) and environmental reasons (‘palm oil’), compared to other countries. People in France indicated highest willingness to pay a higher price for products carrying either of the two labels.

Additional analyses across country, label and products revealed that healthiness evaluations did not differ between men and women, and healthiness evaluations of the products are positively correlated. Those who tend to evaluate ‘lactose-free’ products as healthier also evaluate the ‘gluten-free’ products to be healthier.

In general, ‘free-from’ labelled products are perceived to be healthier compared to products without such a label, and this effect was especially significant for ‘palm oil-free’ and ‘GMO-free’ products.

Finally, this study demonstrates that ‘free-from’ labels appear to be generally confusing for consumers and that a sound consumer education in ‘free-from’ labelling claims is necessary. A cautious approach must be applied however as, if the consumer’s expectation – that food with a ‘free-from’ label is healthier – is not met, then this may result in distrust in the industry.

Click here to access the publication.

PDF version: EUFIC Forum N°8