5 trending alternative protein sources to meat in Europe

Last Updated : 17 March 2023The EU market for alternative proteins has been growing steadily in recent years, with meat and dairy alternative sales increasing by 10% annually between 2010 and 2020.1 But what are the trending “alternative proteins”? This article explains why we should take them seriously and shows five options that may help to reduce the amount of meat on our plates.

What are alternative proteins and why do we need them?

In Europe, meat, fish and dairy products have long been the main source of protein in the diet. However, the way we produce food depends heavily on intensive animal farming and fisheries, threatening the environment. With the global population growing fast, food systems need alternatives that can help meet the growing demand for protein sustainably. Increasing the diversity and reducing the amount of protein we eat will be crucial to reach this goal.2

Alternative proteins refer to non-traditional high-protein foods.3 These innovative foods aim to compete with conventional animal products by offering sustainable, nutritious, and tasty protein-rich choices. There are five main protein alternatives under development in Europe: plant-based meat substitutes, lab-grown meat, fermentation products, edible insects and algae.2

1. Plant proteins and plant-based meat and dairy analogues

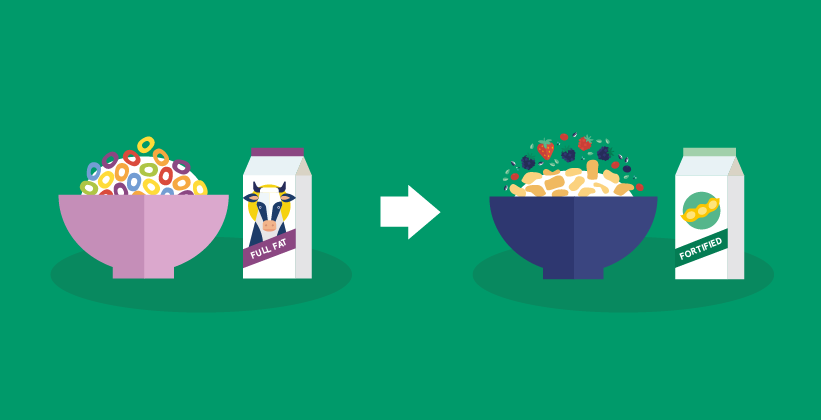

Plant-based meat substitutes and dairy analogues are foods that are designed to look, cook and taste like meat or dairy products, using ingredients like vegetables, pulses, cereals, nuts and seeds. Technology is being used to make plant-based alternatives more sophisticated, with some vegetable burgers currently replicating the medium-rare effect of a regular burger by using beet juice to make the patty “bleed”.4

The upside of plant proteins is that producing them needs fewer natural resources and causes significantly lower greenhouse gas (GHG) emissions, compared to farmed animals. Still, the environmental impact of the final products will depend on other factors such as the ingredients used and the processing and distribution techniques. Being plant-based however, does not necessarily mean all these products are healthy, as some may still be high in salt or saturated fats, or poor in micronutrients that we generally get from animal foods.

Eating plant-based proteins generally faces less consumer resistance than other alternative proteins, and advances in technology will help improve the product’s appeal and lower prices, which could persuade more people to choose them.4,5

2. Cultured or cultivated or lab-grown meat

To grow meat in a lab, stem cells are collected from animals and added to a nutrient-rich medium where they multiply and grow into muscle tissue with the help of scaffolds.6 By removing animal farming from the equation, cultured meat aims to offer a more environmentally friendly and ethical alternative to meat, without renouncing taste and texture. But despite its ambitions, the current production of cultured meat still faces major technical, regulatory and financial barriers. The most notable are the high costs of production and the use of energy-intensive technology.7

Besides the need to improve the taste and texture of lab-grown meat, the industry still has to learn how to make the transition from small-scale processes to cost-efficient mass production if it is to become available to more people at a reasonable price. We also need more data on the nutritional quality and safety of cultured meat products if they are to be approved by European regulators, although some lab-grown meat products have already passed a risk assessment and been approved for sale in Singapore. If large-scale production becomes feasible and affordable, consumer acceptance will be another challenge to overcome before cultured meat becomes common on the market.7 Read more about how lab-grown meat is made and its benefits and challenges in this article.

3. Fermentation-derived options like mycoprotein

Similar to traditional fermentation – in which microbes convert specific compounds in foods, changing texture and flavour – biomass and precision fermentation use microorganisms to generate alternative proteins.8

Biomass fermentation uses the rapid growth of some protein-rich microorganisms to make large amounts of protein. Specific organisms, from yeast to filamentous fungi to microalgae, can double their weight in just a few hours and contain over 50% protein by dry weight. The resulting microbial biomass can be used as a food product on its own or as an ingredient in blended foods. A popular example is mycoprotein, which uses fermentation to grow filamentous fungi which are used to create meat substitutes.8

Precision fermentation introduces gene sequences of animal proteins in organisms like yeast, which use these “production instructions” to generate large amounts of the target proteins. The resulting proteins are then mixed with other ingredients (like plant-based fats) to create animal-free products that aim to compete with meat, seafood, eggs and dairy products. Currently, some European and US-based companies use precision fermentation to produce egg proteins, dairy proteins and myoglobin - a protein found in meat responsible for its unique taste and aroma.8 In the EU, these products would be classified as novel foods and would need to undergo a risk assessment by the European Food Safety Authority (EFSA) before being allowed on the market.

One advantage of fermentation is the ability to create fibrous textures that come closer to those of whole-cut meats and are typically hard to replicate. Still, large-scale production is at an immature stage, and both processes still need to become more cost-efficient, as well as comply with food safety regulations. This could be achieved by improving and exploring new strains of microorganisms and improving the design of the bioreactors used in production.8

4. Edible insects

Despite being traditional in other countries, insects are considered novel foods in Europe and need the European Food Safety Authority’s approval before they can be sold. There are four species legally approved for sale in Europe - migratory locust, house cricket, yellow mealworm and lesser mealworm. Some of these are already used to make protein bars, flours and other products that can be found on supermarket shelves.9

Insects like crickets, grasshoppers and locusts can have up to 61% protein by dry weight, making them suitable candidates to enrich food and feed products. One of insects’ biggest advantages is that they reproduce quickly and need less feed than other animals. They can also be fed organic side-streams (from manure to food waste), which reduces pollution and production costs.10 However, eating insects is not without risks as some may have the potential to trigger allergic reactions similar to those seen with shellfish. Consumer acceptance will be a major barrier to overcome if insects are to be successfully introduced to people’s diets in Europe, as many European consumers are as yet unwilling to try eating insects.11

5. Algae

The algae family includes macroalgae (seaweed) and microalgae, both of which have been pointed out as key sources of alternative protein for a sustainable food system and global food security.12 Particularly, microalgae are gaining traction as competitive protein-rich ingredients for food and animal feed.

Microalgae are microorganisms – generally made from one single cell - that multiply quickly into nutrient-rich biomass, using water, light and a source of nutrients, like carbon dioxide. They are known for their high protein content. Species like Spirulina can have up to 70% of their dry mass as protein, and the protein quality of species like C. vulgaris and A. platensis is comparable to soybean. Plus, their production can contribute to a circular economy as they have the potential to grow on wastewater and be fed on different organic wastes or side streams (such as food waste, food processing byproducts, or carbon dioxide from the air).13

Currently, at least 30 countries produce some type of microalgae and research is helping the industry take the leap from small to large scale.13 Bottlenecks include the high costs of production and energy requirements, as well as the need for more efficient cultivation and processing techniques. The ProFuture project is investigating innovative processes to make large-scale cultivation more cost-effective and sustainable. Researchers are also working on creating ingredients that have a less strong (green) colour and marine taste, in order to increase consumers’ acceptance of microalgae-enriched food.

Conclusions

Plant-based meat analogues, cultured meat, microbial products, edible insects and algae have the potential to offer more sustainable protein sources to help replace conventional ones in food and feed products. However, the health, safety and environmental impacts of the different foods will ultimately depend on the ingredients used, the production and processing techniques, as well as the context in which they are added to the diet.14

Recently, alternative proteins have become a key area of research for the European Commission, leveraging their potential to help make food systems more sustainable and resilient.4 Public-funded research and innovation will play a key role in addressing these challenges. This includes overcoming financial and technical barriers to large-scale production, reducing energy demand, improving the products’ sensory aspects (like taste and texture) and meeting food safety regulatory requirements.

The way forward

A number of EU-funded projects aim to open the way for alternative proteins in Europe, for example, ProFuture, creating innovative microalgae foods and feeds, NextGenProteins which works on transforming biomass into proteins, SUSINCHAIN, focusing on sustainable insect value chains and Smart Protein, aiming to produce a new range of sustainable, nutritious, and cost-effective protein-rich foods. Such large-scale collaborations are crucial to explore the full potential of different alternative protein sources, bring variety to our protein consumption and eventually help make our food systems more resilient.

This article was produced in collaboration with ProFuture. ProFuture has received funding from the European Union’s Horizon 2020 Research and Innovation programme under Grant Agreement No. 862980.

This article was produced in collaboration with ProFuture. ProFuture has received funding from the European Union’s Horizon 2020 Research and Innovation programme under Grant Agreement No. 862980.

References

- ING (2020). Growth of meat and dairy alternatives is stirring up the European food industry. Accessed February 19, 2022.

- EIT Food (2022). Protein Diversification – an EIT Food White Paper.

- European Food Safety Agency (EFSA) website. Novel food section. Assessed February 19.

- He J, Evans NM, Liu H, et al. (2020) A review of research on plant-based meat alternatives: Driving forces, history, manufacturing, and consumer attitudes. Comprehensive Reviews In Food Science And Food Safety 19(5)2639-2656.

- Nezlek BJ, Forestell, AC (2022) Meat substitutes: current status, potential benefits, and remaining challenges. Current Opinion in Food Science 47:100890.

- Siddiqui, S, et al. (2022) Cultured meat: Processing, packaging, shelf life, and consumer acceptance, Lebensmittel-Wissenschaft und-Technologie 172:114192.

- Ye Y, Zhou J, Guan X, et al. (2022) Commercialization of cultured meat products: Current status, challenges, and strategic prospects. Future Foods 6:100177.

- Good Food Institute (2021). State of the Industry Report: Fermentation.

- European Commission. Approval of fourth insect as a Novel Food: Questions and Answers section. Accessed February 19, 2022.

- Lange WK & Nakamura Y (2021). Edible insects as future food: chances and challenges. Journal of Future Foods 1:38-46.

- Mina G, Peira G & Bonadonna A (2023) The potential future of insects in the European Food System: A systematic review based on the consumer point of view. Foods 12(3):646.

- European Commission (2020). Farm to Fork Strategy.

- Gohara-Beirigo, A et al. (2022) Microalgae trends toward functional staple food incorporation: Sustainable alternative for human health improvement. Trends in Food Science & Technology 125:185-199.

- IPES-Food (2022) The politics of protein: examining claims about livestock, fish, ‘alternative proteins’ and sustainability.